76+ pages advantages of reducing balance method of depreciation 1.4mb. Our accounting lectures will be. Reducing balance method equalizes the yearly burden on profit and loss account in respect of both depreciation. The main advantage of this method is that it allows a greater depreciation for the first years of the assets life. Check also: method and understand more manual guide in advantages of reducing balance method of depreciation Depreciation is calculated every year on the opening balance of asset.

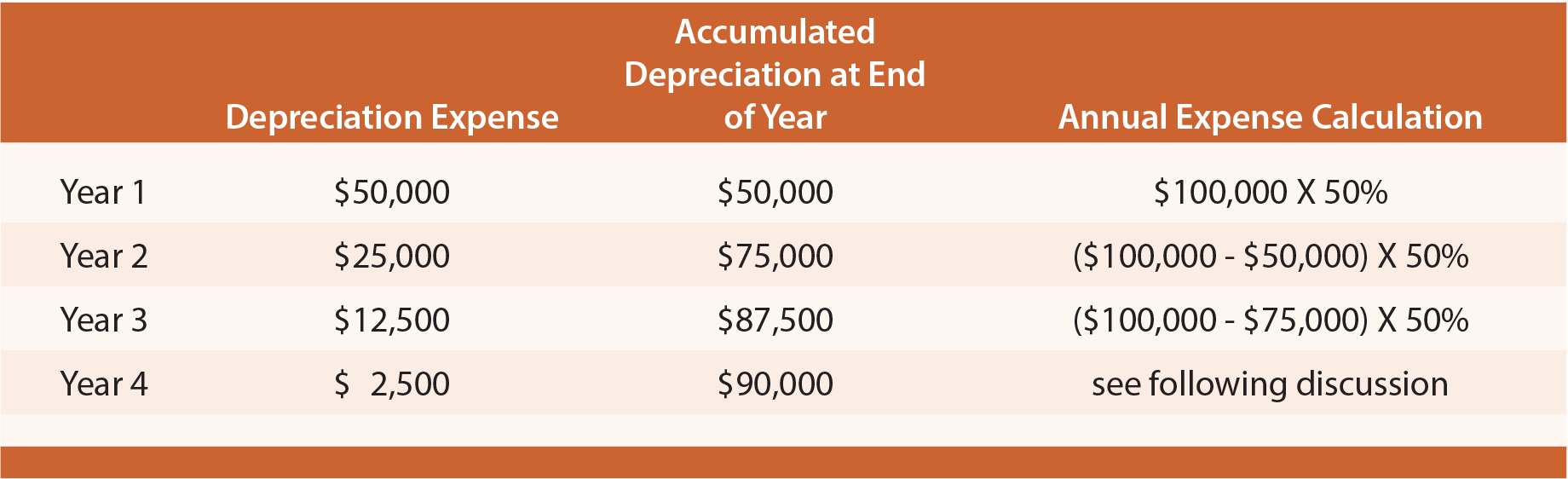

Every year there is an equal burden for using the asset. Under reducing balance method the amount of depreciation is calculated by applying a fixed percentage on the book value of the asset each year.

Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot

| Title: Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

| Format: PDF |

| Number of Pages: 175 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: November 2021 |

| File Size: 1.7mb |

| Read Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

|

Advantages of reducing balance method of depreciation.

It is a good application of the matching concept. It matches costs with revenue received. The amount of depreciation reduces as the life of the asset progresses. The depreciation rate is the division of the number 15 or 2 in case you prefer double-declining-balance method by the assets useful life. The reducing balance method of depreciation results in declining depreciation expenses with each accounting period. Most businesses would rather receive their tax break sooner rather than later.

Depreciation Methods Principlesofaccounting

| Title: Depreciation Methods Principlesofaccounting |

| Format: eBook |

| Number of Pages: 159 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: December 2020 |

| File Size: 5mb |

| Read Depreciation Methods Principlesofaccounting |

|

Double Declining Depreciation Efinancemanagement

| Title: Double Declining Depreciation Efinancemanagement |

| Format: eBook |

| Number of Pages: 230 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: September 2020 |

| File Size: 1.1mb |

| Read Double Declining Depreciation Efinancemanagement |

|

Methods Of Depreciation Learn Accounting Method Fixed Asset

| Title: Methods Of Depreciation Learn Accounting Method Fixed Asset |

| Format: ePub Book |

| Number of Pages: 225 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: November 2017 |

| File Size: 6mb |

| Read Methods Of Depreciation Learn Accounting Method Fixed Asset |

|

Straight Line Vs Reducing Balance Depreciation

| Title: Straight Line Vs Reducing Balance Depreciation |

| Format: ePub Book |

| Number of Pages: 292 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: August 2020 |

| File Size: 1.5mb |

| Read Straight Line Vs Reducing Balance Depreciation |

|

Depreciation Written Dawn Value Diminishing Balance Method

| Title: Depreciation Written Dawn Value Diminishing Balance Method |

| Format: ePub Book |

| Number of Pages: 253 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: June 2018 |

| File Size: 800kb |

| Read Depreciation Written Dawn Value Diminishing Balance Method |

|

Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot

| Title: Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

| Format: eBook |

| Number of Pages: 206 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: February 2019 |

| File Size: 1.3mb |

| Read Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot |

|

How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator

| Title: How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

| Format: eBook |

| Number of Pages: 154 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: April 2017 |

| File Size: 2.6mb |

| Read How To Calculate Depreciation On Fixed Assets Fixed Asset Economics Lessons Calculator |

|

O Level Accounting Methods Of Calculating Depreciation

| Title: O Level Accounting Methods Of Calculating Depreciation |

| Format: PDF |

| Number of Pages: 140 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: August 2020 |

| File Size: 1.35mb |

| Read O Level Accounting Methods Of Calculating Depreciation |

|

Reducing Balance Method For Calculating Depreciation Qs Study

| Title: Reducing Balance Method For Calculating Depreciation Qs Study |

| Format: ePub Book |

| Number of Pages: 181 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: February 2019 |

| File Size: 800kb |

| Read Reducing Balance Method For Calculating Depreciation Qs Study |

|

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula

| Title: What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula |

| Format: ePub Book |

| Number of Pages: 333 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: October 2017 |

| File Size: 1.9mb |

| Read What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro Accounting School Work Formula |

|

Diminishing Balance Method Reducing Balance Method Taxdose

| Title: Diminishing Balance Method Reducing Balance Method Taxdose |

| Format: eBook |

| Number of Pages: 223 pages Advantages Of Reducing Balance Method Of Depreciation |

| Publication Date: December 2017 |

| File Size: 810kb |

| Read Diminishing Balance Method Reducing Balance Method Taxdose |

|

Advantages of Declining Balance Method of Depreciation A major advantage of the declining balance method of depreciation is that it matches the costs of the asset to the revenue it generates. Under the reducing method the business is able to claim a larger depreciation tax deduction earlier on. The reducing balance method of depreciation is most useful when an asset has higher utility or productivity at the start of its useful life as it results in depreciation expenses that reflect the assets productivity functionality and capacity to generate revenue.

Here is all you need to read about advantages of reducing balance method of depreciation The major advantage of the reducing balance method is the tax benefit. In other words it charges depreciation at a higher rate in the earlier years of an asset. Under this method a constant rate of depreciation is applied to an assets declining book value each year. Depreciation written dawn value diminishing balance method diminishing or reducing balance method of depreciation ilearnlot how to calculate depreciation on fixed assets fixed asset economics lessons calculator depreciation methods principlesofaccounting what is diminishing balance depreciation definition formula accounting entries exceldatapro accounting school work formula diminishing balance method reducing balance method taxdose The depreciation has to be recalculated each year.

0 Comments